LBO Model Excel Template

Leveraged buyout model spreadsheet. Calculate IRR for your investments. Ready for presentations with dynamic charts. Easy to use Excel template.

TEMPLATE DESCRIPTION

LBO Model Excel Template will basically define the MoIC (Multiple on Invested Capital) and IRR (Internal Rate of Return) of your investment according to the main assumptions. It will also give you an overall analysis of the acquisition with dynamic charts.

A leveraged buyout (LBO) is basically the acquisition of a target company by an investor using a significant amount of debt. The debt funding is the key issue in LBO Model, as this will serve as leverage in excel.

All you need is to input your assumptions and the remaining will be done in excel. The good news is: If you are not familiar with financial terms, do not worry. This LBO model excel tool includes a comprehensive guide to lead you through the model.

LBO Model Excel Template Main Features

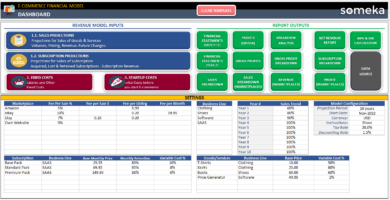

This one-sheet excel template consists of 3 main sections:

Let’s have a deeper look into the main sections:

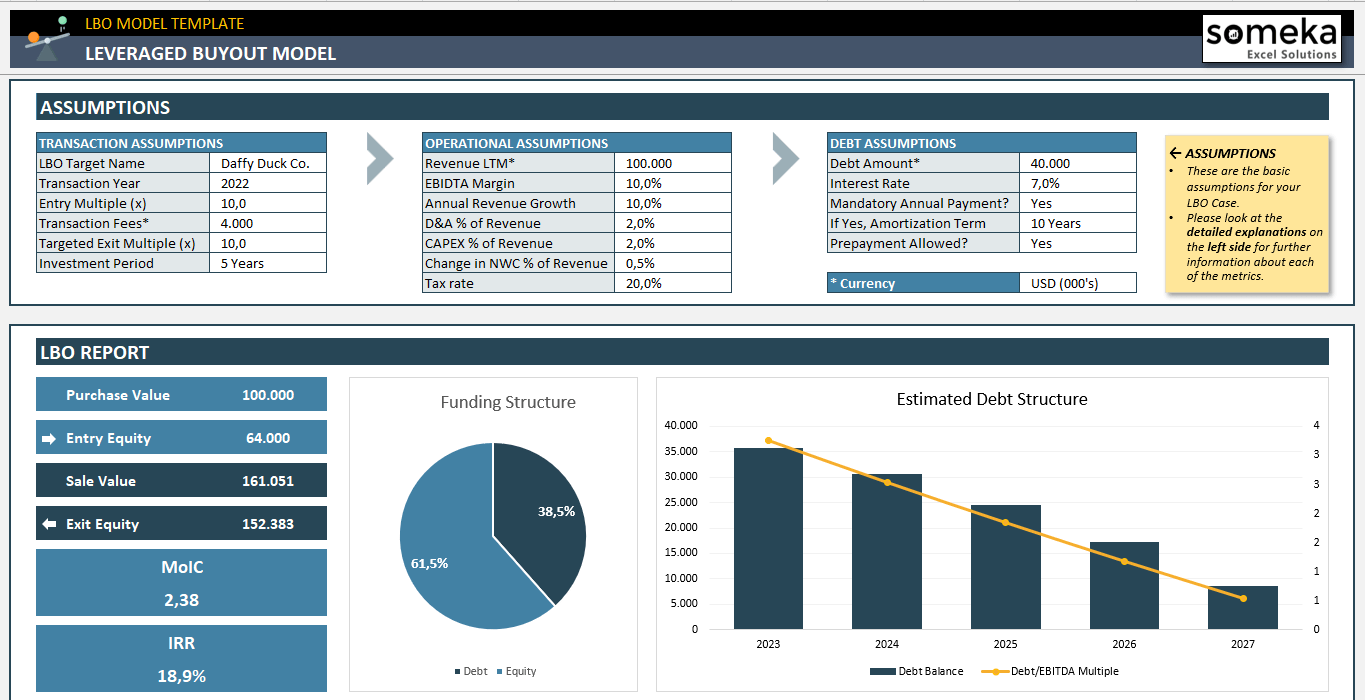

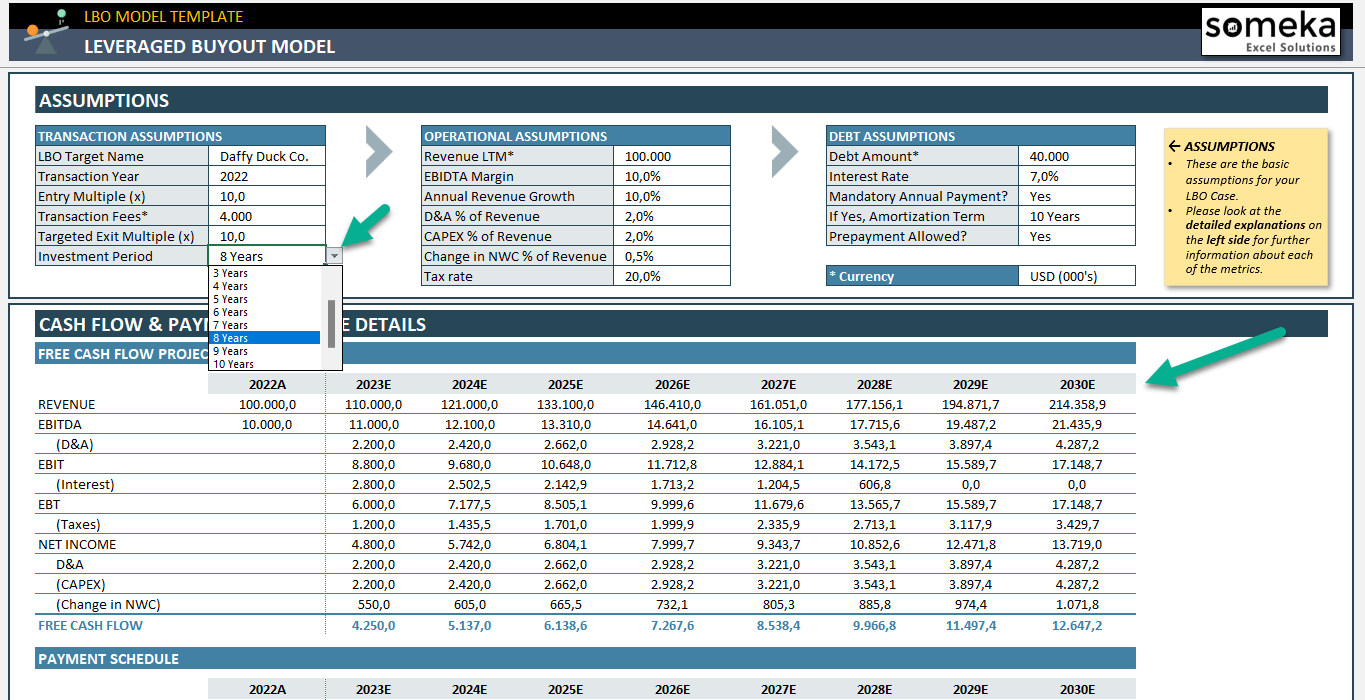

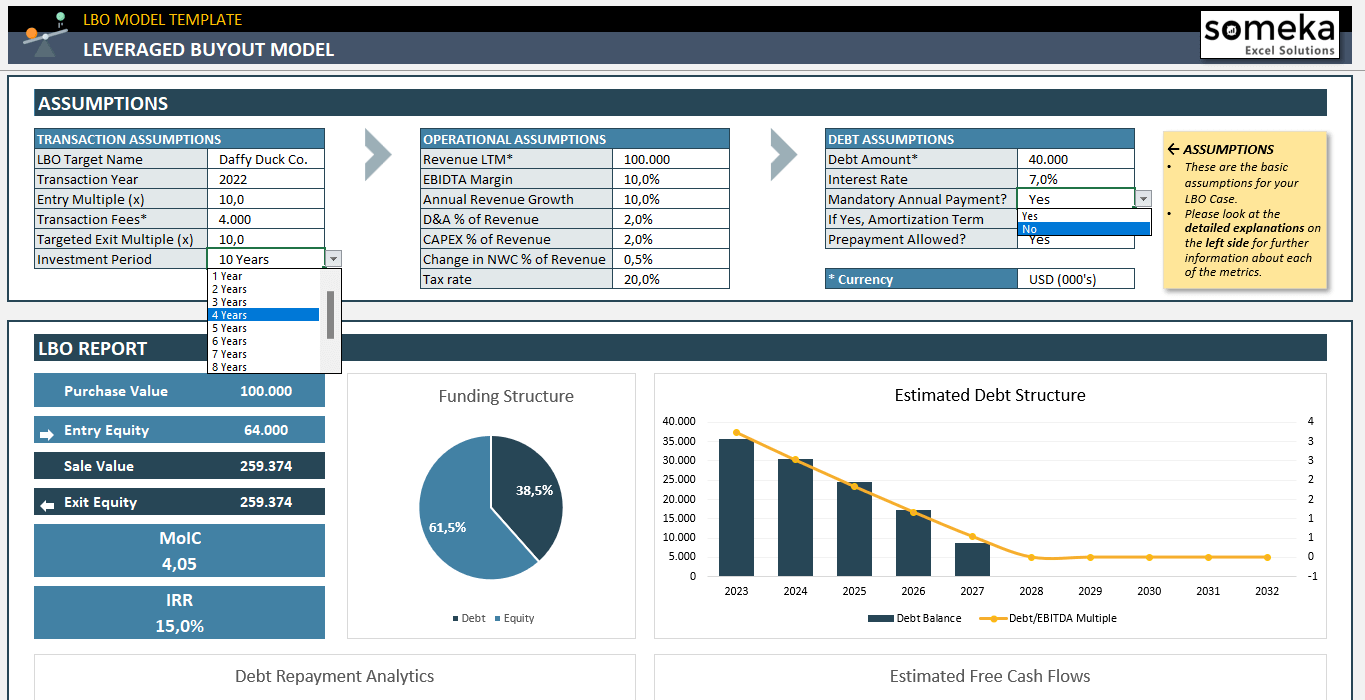

1. Assumptions

This is the input section of the template. You will fill out only this section, and then the LBO model excel template will do the other parts. There are three main assumptions:

- Transaction Assumptions: These are related to the transaction conditions such as target name, acquisition year, entry multiple, transaction fees, targeted exit multiple, and anticipated investment period.

- Operational Assumptions: Here is the info about the target company’s operations. These will include the last twelve months’ revenue, EBIDTA margin, annual revenue growth, tax rate, and D&A, CAPEX, and NWC percentages.

- Debt Assumptions: These are related to the debt that is used during the acquisition. To simplify the method, there’s a one-type debt assumption. You will input the total debt amount and interest rate.

You will also define if the debt includes a mandatory payment clause and if the prepayment is allowed by the creditors. If there’s a mandatory payment clause, you should select “Yes” from the dropdown menu and should also indicate the mandatory amortization rate. If the creditors allow for a prepayment, then the excel template will allow making a payment if you have a free cash flow available.

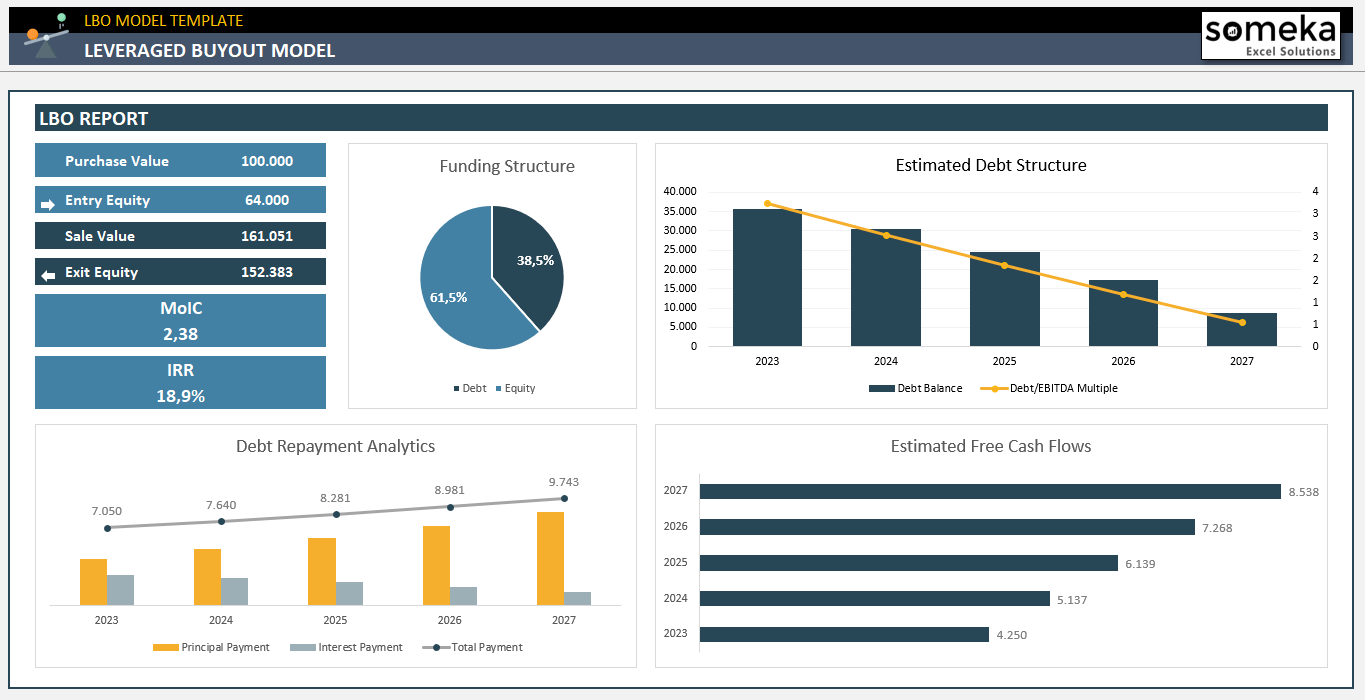

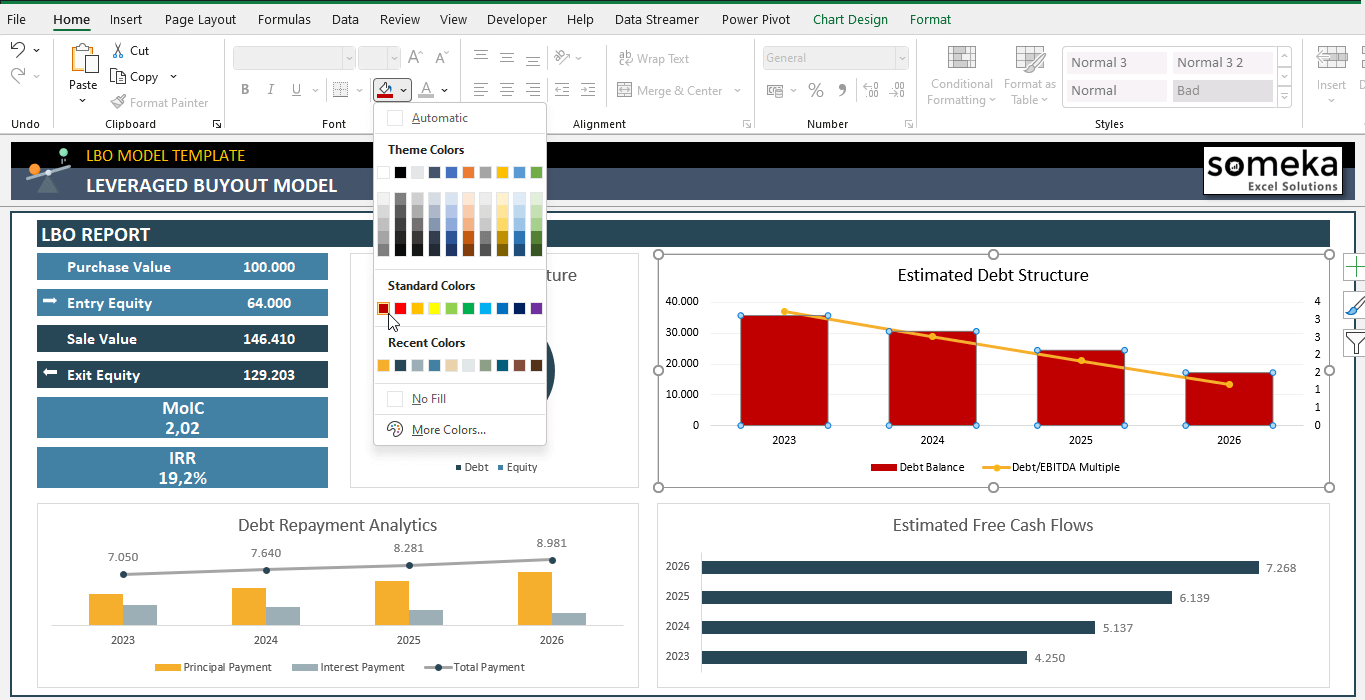

2. LBO Report

This section displays the results of your LBO model

Compare the MoIC and IRR of your investment with industry averages and with your targets. You may also see your purchase value and entry equity vs. sale value and exit equity.

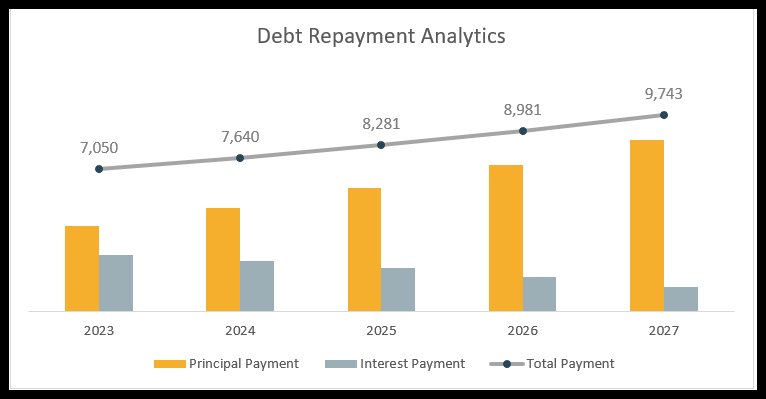

The report also includes dynamic charts to show you the funding structure, estimated debt structure, debt repayment analytics, and estimated free cash flows all in Excel!

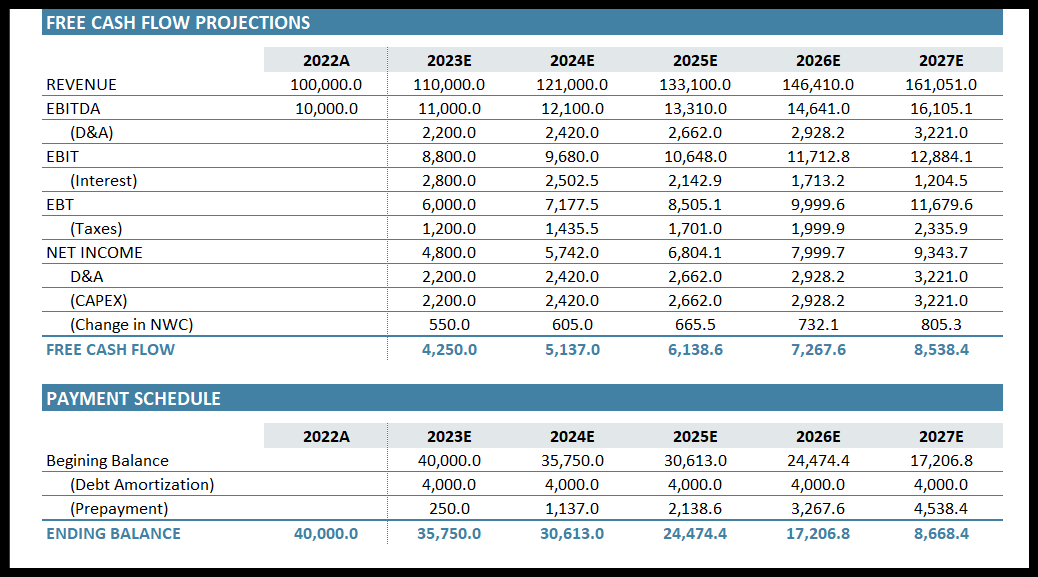

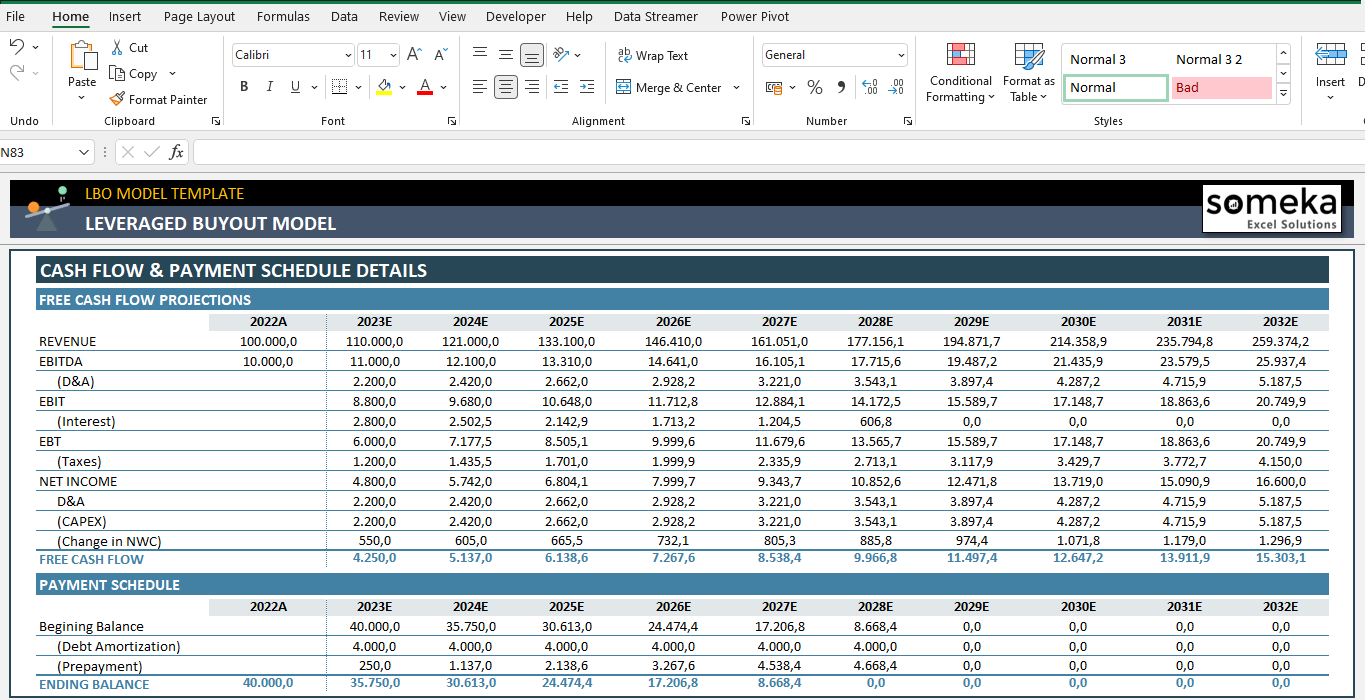

3. Cash Flow & Payment Schedule

This section brings you a breakdown of your annual free cash flows and detailed payment structure. The table enlarges dynamically according to the investment period selected under the transaction assumptions. You can see all your yearly results for the coming period.

This LBO model excel tool includes a comprehensive guide. All the metrics are explained in detail. This will be a great reference for not only evaluating any investment but also for understanding the basics of leveraged buyout model.

As a final word, this basic LBO model template is a helper for you to analyze your investment projection in an excel tool, but of course, does not include any investment advice.

LBO Model Excel Template Features Summary:

- Includes a clear guidance about the LBO model

- Calculates the MoIC and IRR of the investment

- Full print ready

- Informational notes

- No installation is needed, ready to use

- Works both on Mac and Windows

- Compatible with Excel 2010 and later versions

- Does not include any VBA code or macros

USER REVIEWS & COMMENTS

9 reviews for LBO Model Excel Template

You must be logged in to post a review.

Martin Stanley –

Thank youuu guys, what a clear model!

Toby –

Love love love this so much. we will aslo pay commissions for the bank loan. Where to calculate it?

Someka –

Hi Toby,

You can add any one-off expenses, including but not limited to bank commissions, as a transaction fee under the transaction assumptions.

Hope this helps!

Jennifer B –

Hi very clean and easy-to-use template! Any chance to put this template on our website?

Someka –

Hi Jennifer,

After purchasing a Multi-User license, you can share the template with your colleagues in your organization but you’re still not allowed to put it on websites with public access or to resell it.

For more information please click here.

Kevin –

hello, I want to pay my loans with all the cash flow? How is it?

Someka –

Hi Kevin,

Thank you for asking this question.

You may select “No” for mandatory payment, and “Yes” for prepayment allowance. Then all your free cash flow will be used for loan payments.

Please do not forget to check the yellow notes on the right side of the template for detailed explanations.

Jeffrey T –

It works as presented and we will use it. but want to remove your logo????

Someka –

Hello Jeffrey,

You can remove the logo or replace it with your own logo for each sheet. For Free Versions, you are not allowed to remove the logo or alter any copyrighted material in the template.

You can do it in the full version. Please check how to do that in this link.

Hope this helps!

Elmo L –

thank you team

Jane J. Miller –

Hi Someka,

Great tool. I study investment audit and this template saved my life!

Someka –

Hi Jane,

Thank you very much for your kind words.

Please do not forget to check our other accounting and financial templates, which we believe may help you too 🙂

Marilyn J. Stiffler –

Incredibly helpful spreadsheet but what is nwc?

Someka –

Hi Marilyn,

NWC is an abbreviation for Net Working Capital.

You should input the rate of change in Net Working Capital (NWC) to the total revenues, which will be used for free cash flow calculations.

If you’re not familiar with financial terms, our template also includes a comprehensive guide, where you may find explanations for each of the terms as well as the LBO model.

Gil –

GREAT!!!